This Might Be My Best Idea for 2022

This is turning into a funny year. Stocks are going down. Interest rates are set to go up. And I’m focused on gold.

A Quick Guide to Opening Your First Investment Account

If you’re unsure if your employer sponsors a 401(k) plan… pick up the phone, call your HR department, and ask. Do not run to Chipotle first. This is far more important.

Diversification Is No Defense Against a Bear Market

Investors are all gorked up on crypto. But the problem with that isn’t crypto. The problem is poor portfolio construction.

Saving for Retirement Isn’t That Complicated

For the past few weeks, we’ve been walking through the necessary steps to get your personal finances in order. Step one, build up your emergency fund. Step two, start hacking away at debt. Step three, save and invest.

How much? The short answer is: As much as humanly possible. If you start investing in your 20s, that means at least 20% of your take-home pay.

Say your salary is $5,000 per month. Around 20% will come out in taxes, Social Security payments, etc. All the deductions that happen before you see your paycheck. Whatever is left is your take-home pay. So, in this example, we’ll say it’s $4,000. That means you want to save at least $800 a month.

-

What if you can’t set aside 20%?

Do not let perfect be the enemy of good. If you start investing 10% or 15% of your take-home pay when you’re 22, you are light-years ahead of the guy who’s investing nothing, even if he’s earning more money.

The most important thing is to start investing as early as possible. Then rein in your expenses so you can start stashing away 20% as soon as possible. That may involve some discomfort, but believe me, you want to make those changes now. It’s much easier to drive a junky car, live in a sketchy neighborhood, and subsist off of canned beans when you’re 22 than when you’re 82.

-

Now, what if you’re only beginning to invest in your 40s or 50s?

Twenty percent isn’t going to cut it. Instead, your goal is to invest half of your take-home pay. The reality is you are playing catch up. You don’t need to panic—everything is going to be okay, as long as you start investing half of your take-home pay. Now.

The Slacker’s Plan

At the very least, you want to make the maximum contribution to an IRA every year. For everyone under age 50, the limit is $6,000 a year. You can do that! Think about it… $6,000 a year is $500 a month, or about $17 a day.

That's it. That is all you need to max out an IRA. And as an added bonus, you will lower your taxes, since contributions to a traditional IRA are tax deductible. Or you can opt to pay the taxes now and invest in a Roth IRA—then you get to withdraw the money tax-free in retirement.

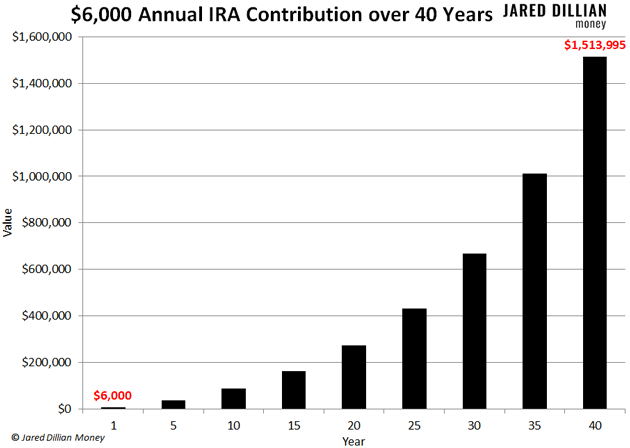

Look, if you save $6,000 a year for 40 years, which is very doable, that's $240,000 before any investment returns. Factor in an average annual return of 7.9%—the average annual return over the last 40 years for a portfolio of 50% stocks and 50% bonds—and you’re looking at $1,513,995.

That is a healthy retirement account, and all you had to do was save $17 a day. Simple as that.

Simple, yet only around 36% of US households have an IRA. This is unfortunate because retirement is well within reach for far more people.

We spend a lot of time talking about the big things here at Jared Dillian Money: the house, the car, the student loans. But sometimes you only have to make small-ish changes to put yourself in a radically better position to retire comfortably when you’re ready.

Now you know how much to save. Ideally, as much as humanly possible, starting as soon as humanly possible. At minimum, $17 day.

Next week I’ll show you where to invest that money for the best risk-adjusted returns…

Jared Dillian

|

‹ First < 22 23 24 25 26 > Last ›